Introduction:

The Loan Management System in Odoo offers a comprehensive solution for managing loans for both customers and suppliers. It enables easy tracking of loan amounts, interest rates, and repayment schedules. Users can efficiently process loan applications, disbursements, and payments, ensuring accurate financial records. The system integrates with Odoo's accounting module, providing real-time insights into financial standings. It's ideal for businesses looking to smooth their loan handling processes, offering a user-friendly interface and robust reporting capabilities.

Key features of the Loan Management System:

- Custom loan products configured as per your lending programs

- Loan application forms for borrowers to submit requests

- Workflow for loan officers to process applications

- Credit assessment and approval process

- Disbursal and tracking of loan funds

- Repayment management with reminders

- Closure of loans on repayment

Here are some of the top benefits of using the Loan Management System in Odoo:

Increased Efficiency:

The workflow automation and digitization of records in the system significantly improves efficiency. It eliminates manual processes like physical loan file movement, paperwork, data entries etc. Processes are streamlined, reducing turnaround times.

Enhanced Risk Management:

Centralized data aids in credit assessment during approvals. Loan tracking provides better visibility into the lending portfolio and risk exposure. Timely identification of NPAs based on overdue installments helps in risk mitigation.

Reduced Operational Costs:

Automating manual tasks reduces the operational costs of lending. The system lowers the need for excessive paperwork, documentation, couriering and human resources required for management. This directly improves the bottomline.

Better Customer Experience:

Customers can submit and track loan applications online through self-service portals. Quicker approval and disbursal enhances satisfaction. Reminders for repayments prevent penalties or defaults.

Powerful Reporting & Monitoring:

Dashboard gives real-time overview of the lending business with drill-down reports. Portfolio analysis, collections data and more provide actionable insights for decision making.

Installation:

- Install the Loan Management System module from Odoo Apps or GitHub repository

- Configure loan products - create loan types, set terms, conditions, eligibility criteria etc.

- Customize application forms for each loan type

- Set up users and access rights - loan officers, managers, accountants

Workflow:

- Borrower submits loan application from portal or backend

- Application lands in Loan Officer's dashboard for processing

- Loan officer reviews application, checks eligibility

- Requests supporting documents from borrower if needed

- Submits case for credit review and approval after assessment

- Loan manager reviews and approves/rejects based on policies

- On approval, loan agreement is generated and signed

- Finance dept disburses loan amount to borrower

- Repayment schedule is generated in system

- Borrower repays in installments over the tenure

- System tracks installments and sends reminders

- Loan officer monitors portfolio and manages collections

- On final payment, loan is closed and account settled

HOW TO WORK

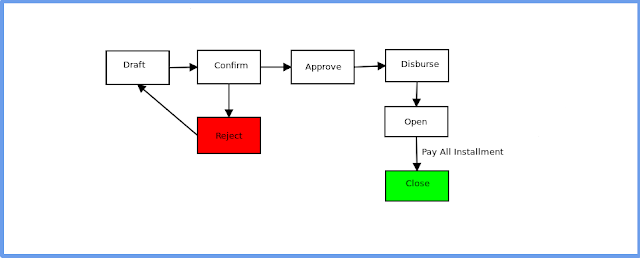

Loan Management Workflow

Create Loan Type

Open Loan

Pay Loan Installment

Advance Payment

Advance Payment Window

Pay Advance Payment

Changes in Last Installment amount

Update Interest Rate

Update Interest Rate Window

Update Interest Rate

Loan PDF Report

Send Installment Due Reminder to Borrower

Print Installment Summary Report Window

Installment Summary Report

Installment Summary Report

Installment Summary On Screen

Print Interest Certificate

Interest Certificate Report

The configurable workflow ensures efficient and automated processing of loan applications to disbursal and repayment. The system provides tools to manage the end-to-end loan lifecycle.

NEED HELP?

Hope you find the guide helpful! Please feel free to share your feedback in the comments below.

To Buy This Odoo App : Click_here

More odoo app : Odoo_Apps

For more odoo information contact us :

Email : devintelle@gmail.com Whatsapp: +91 87805 43446 skype : devintelle

Reach Us:-

Website:- https://www.devintellecs.com/ LinkedIn:- https://in.linkedin.com/in/devintelle-odoo-service-provider-34785b144 Twitter:- http://twitter.com/Odoodevintellecs Facebook:- https://www.facebook.com/Odoodevintellecs/ Instagram:- https://www.instagram.com/devintelle_odoo/ Youtube:- https://www.youtube.com/channel/UCrmu-T0c8rhMXGuB44bH7gA https://wa.me/+918780543446?text='Hello'

Thanks for paying attention!!

No comments:

Post a Comment